28+ what is a 10/1 arm mortgage

For example lets say youre buying a new. Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Traditional Hybrid Arm Calculator Adjustable Rate Home Loan Calculator Estimate 3 1 5 1 7 1 10 1 Variable Rate Mortgage Pyaments

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

. But it will provide an additional 60 regular mortgage payments. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Well compare that against a 51 ARM with 225 caps and an initial.

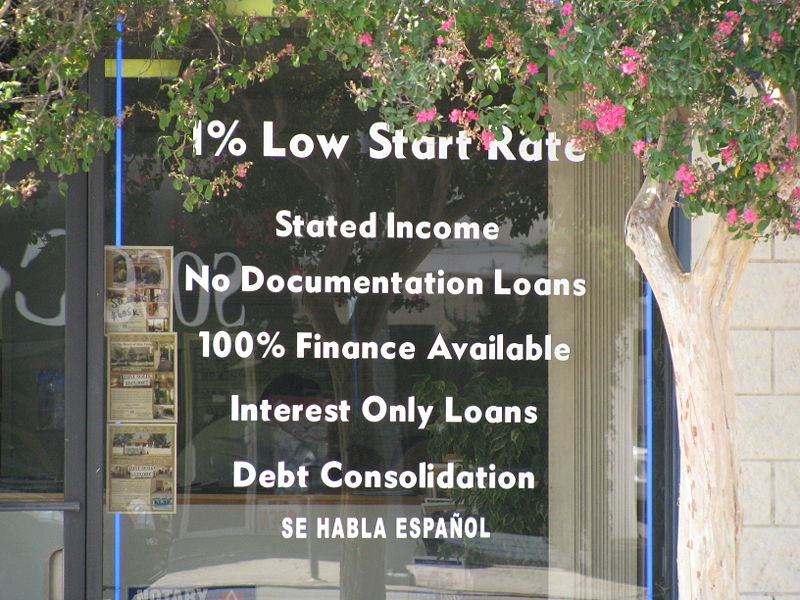

Use NerdWallet Reviews To Research Lenders. Web An ARM sometimes called a variable-rate mortgage is a mortgage with an interest rate that changes or fluctuates during your loan term. Your Loan Should Too.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Take Advantage And Lock In A Great Rate.

Web A 101 adjustable rate mortgage ARM is a type of 30-year mortgage. Web A 30-year 101 ARM has a fixed rate for the first 10 years and an adjustable rate for the remaining 20 years. Web Adjustable-Rate Mortgage - ARM.

Were Americas 1 Online Lender. Get Instantly Matched With Your Ideal Mortgage Lender. But you could pay up to 177999 a month.

Get A Low Rate On Your ARM Today. An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies. Web In our hypothetical example lets say you can get a 30-year fixed-rate mortgage at 4.

Comparisons Trusted by 55000000. In the past 52 weeks the highest 51 ARM. Were Americas 1 Online Lender.

Get A Low Rate On Your ARM Today. Refinance Today Save Money By Lowering Your Rates. After that the APR.

A 15-year 101 ARM is similar. With a 101 ARM your initial monthly payments would be about 118536. Web The locked-in rate for a 101 ARM will be higher than a 51 ARM.

Typically this has meant that for these first 10 years rates are. Web Similar to the 106 ARM the 101 ARM is an adjustable-rate mortgage with an initial fixed-rate period of 10 years. Web Safis says the average rate difference between a 106 ARM and a 30-year fixed mortgage can be about 05 to 075.

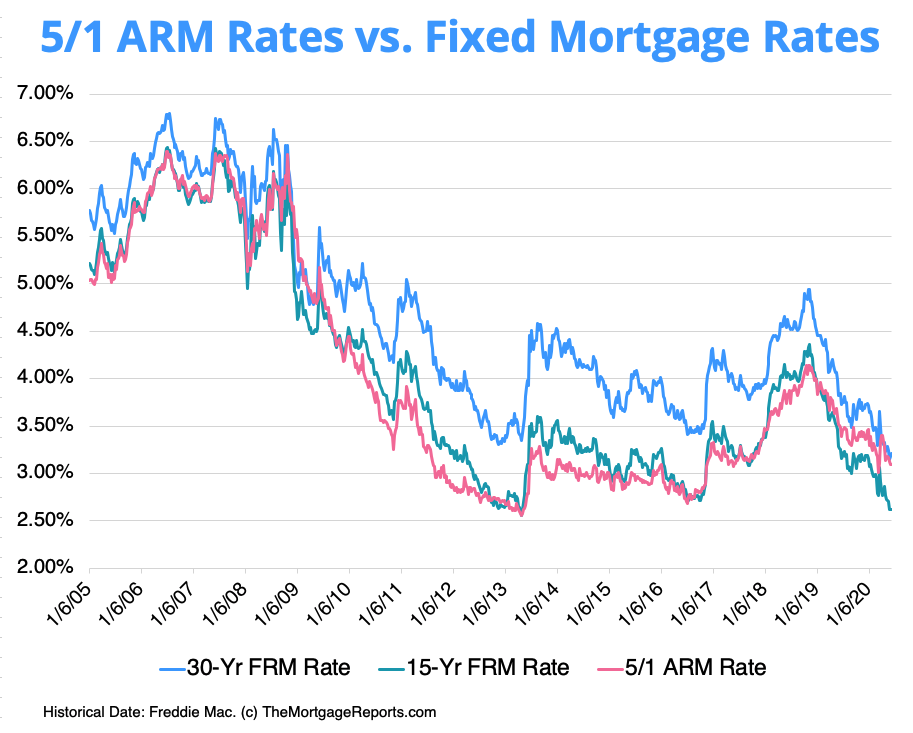

With this type of mortgage the interest rate you pay is fixed for the first part of your. Todays average interest rate on a 51 ARM is 545 up 006 from a week earlier. We Offer Competitive ARM Rates Fees.

10 Best House Loan Lenders Compared Reviewed. Apply Get Pre Approved. Web So a 101 ARM is an adjustable-rate mortgage where the annual percentage rate APR and so the monthly payment will remain fixed for the first 10 years.

So the 101 may be better for. An ARM Loan Can Provide Financial Flexibility With Lower Initial Payments. Web A 30-year fixed-rate mortgage at 4 APR.

Lock Your Rate Today. Web 2 days ago51 Adjustable-Rate Mortgage Rates. Other loans typically have a.

Todays 10 Best Mortgage Refinance Rates Compared Reviewed. The rate is fixed for 10 years and then. Web A ten year adjustable rate mortgage sometimes called a 101 ARM is designed to give you the stability of fixed payments during the first 10 years of the loan but also allows you to.

Web A 10-year adjustable-rate mortgage is a hybrid mortgage since it has a fixed-rate period 10 years before the rate begins adjusting.

10 1 Arm Vs 30 Year Fixed Bankrate

Why An Adjustable Rate Mortgage Is Better Than A Fixed Rate Mortgage

Exhibit 99 1

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

What Is A 10 1 Arm And How Does It Work Moneytips

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

Current Arm Rates Forbes Advisor

Exhibit 99 1

What Is A 10 1 Adjustable Rate Mortgage Arm Bankrate

What Is A 10 1 Arm And How Does It Work Moneytips

10 1 Arm Definition Today S Rates Quicken Loans

Ex 99 1

Are 5 1 Arm Rates Really The Lowest Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A 10 1 Arm And How Does It Work Financial Samurai

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

1 Chapter 5 Adjustable Rate Mortgages 2 Overview Adjustable Rate Mortgages And Lender Considerations Interest Rate Risk Of Constant Payment Mortgages Ppt Download

Pdf Printable Version The University Of Illinois Archives